tax strategies for high income earners book

This is why so many are turning to tax havens as a way to legally minimize their tax liability. Being in the top one percent income level is a big stretch goal for many go-getters.

The 4 Tax Strategies For High Income Earners You Should Bookmark

Book free discovery session Tax Rate Comparisons Federal Individual Income Tax Rates for High-Income Earners 2017Potentially 2026 Rates vs.

. Even with no tax diversification and living in a high. A 250 headline rate for non-trading income or also called passive income in the Irish tax code. Amir carnage4life abebrown716 and amir.

Full PDF Package Download Full PDF Package. A top 1 income is over 500000. Amid employee frustration over wages and high staff turnover.

Expand the Child Tax Credit CTC and the Earned Income Tax Credit EITC. And of course if you live in a more expensive state it takes a higher level of income to be in the top one percent. Book a free discovery session today.

Short-term capital gains are taxed as ordinary income with rates as high as 37 for high-income earners. Notice the difference in taxes between someone married filing jointly compared to a single person. A 125 headline rate for trading income or active businesses income in the Irish tax code.

After state and local taxes are collected the average after-tax income of Texass top earners stands at 140 times the size of the average after-tax income of the states low-income residents. Understanding and Engaging High Net Worth Donors of Color. By Urvashi Vaid and Ashindi Maxton.

Never sat in it. Personal expenses under 20 of gross income LCOL no state income tax so geographically arbitraged. This is the predictable result of charging low-income families a 130 percent effective tax rate while asking high-income families to pay just 31.

Then see how the strategies change when you switch to higher rates for 2026 and beyond. Of states that do levy an income tax nine of them tax long-term capital gains less than ordinary income. I recall Tony Robbins sellingbeing an affiliate for a 25K coaching class.

FTX had revenue of 102B in 2021 up from 89M in 2020. Sadly back in 2012 a top one percent. He had full clarity in selling without seeing.

Austria is the 12th richest country in the world in terms of GDP per capita has a well-developed social market economy and a high standard of living. Aside from the high-income tax rate it also has a social security rate of 18 bonus payments are charged at a rate of 6 and capital gains tax is 25. Most bloggers lack this clarity.

In 2022 a top one percent income threshold is at least 470000. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. 2 Full PDFs related to this paper.

Most developed Western nations have extremely high progressive tax systems in which high earners and companies lose significant amounts of their income to tax. Operating income grew from 14M to 272M. The periodic payments can be set up to last for the rest of the investors life offering protection against the possibility that the.

Get 247 customer support help when you place a homework help service order with us. US accounted for less than 5 of revenue Find. The Child Tax Credit provides a 2000 per child tax credit for parents but excludes the lowest earners ie those with the smallest tax bills from receiving the full credit.

The book is jam packed with unique strategies to help you build your fortune while living your best life. 46 A major issue with the tax credit is that firms that could gain from the credit choose not to use it suggesting that the revealed preferences method would produce a much higher cost estimate. By widening the federal tax brackets applied to the same amount of income you lower your federal marginal tax rate from 22 to 12 and your effective rate by almost 6 compared to a single filer all else equal.

The Millionaire Next Door Book-MANTESHPDF. But the guy made millions. Making a million dollars a year or more puts you in the top 01 of income earners in the world.

Making sense of the latest news in finance markets and policy and the power brokers behind the headlines. As of November 2018 there are two rates of corporation tax CT in the Republic of Ireland. The tax applies to property that is transferred by will or if the person has no will according to state laws of intestacyOther transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts.

A short summary of this paper. Long-term capital gains tax rates are 0 15 20 or 28 with rates applied according. The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies.

Tax payments on income and gains are deferred to age 59½. Taxpayers often forgo tax strategies that would reduce their tax burden because of the compliance costs associated with those strategies. These states include Arizona Arkansas Hawaii Montana New Mexico North Dakota South.

Some estimates have a top one percent income at over 500000. You can sell affiliate stuff if you did not use the stuff but a high high high really high level of clarity is required to do this. Try running the tool at current tax rates.

Trading relates to conducting a business not investment trading.

Do You Follow A Set Of Rules Reality Quotes Positive Motivation Class Quotes

How The Middle Class Has Benefited From The U S Tax System For Decades The Washington Post

Korea Tax Income Taxes In Korea Tax Foundation

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

3 Tax Strategies For High Income Earners Pillarwm

Tosi Shajani Llp Chartered Professional Accountants Advisors

Difference Between High Income Earners And Being Rich Amazing Inspirational Quotes Quotes To Live By Reminder Quotes

Biden S Build Back Better Will Raise Taxes On 30 Of Middle Class Families

Korea Tax Income Taxes In Korea Tax Foundation

Effects Of Income Tax Changes On Economic Growth

Tax Saving Strategies For Your Family And Business Owners

Korea Tax Income Taxes In Korea Tax Foundation

How The Middle Class Has Benefited From The U S Tax System For Decades The Washington Post

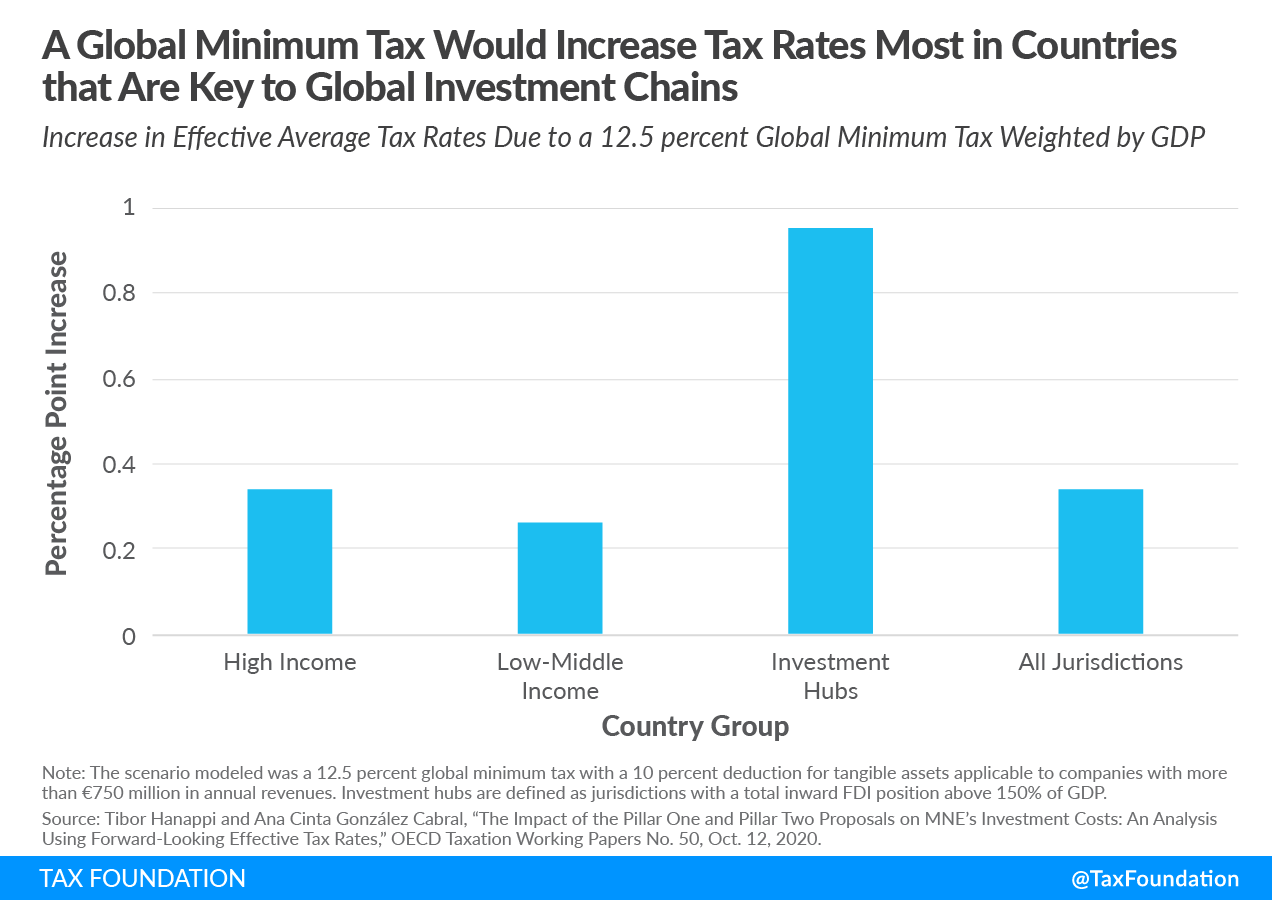

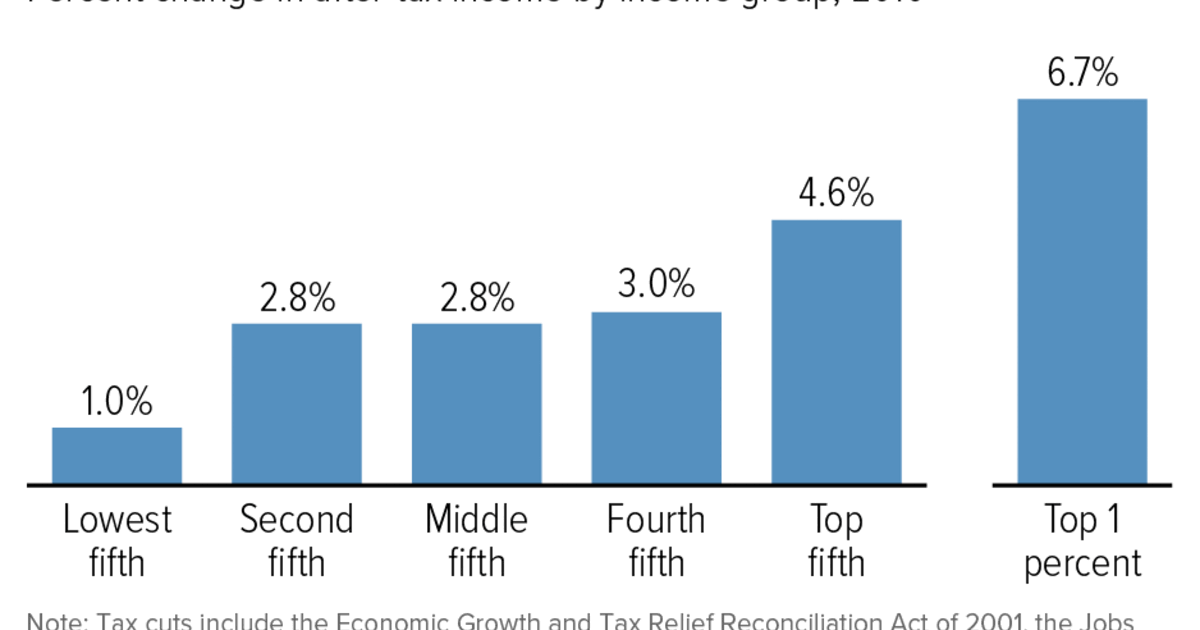

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

Ceci Marshall Finance Mentor On Instagram Follow Financesreimagined For More Finances And Wealth Building Tips As I P Finance Roth Ira Wealth Building

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes 1 9781734792607 Mackwani Adil N Books

Asset Protection For Business Owners And High Income Earners How To Protect What You Own From Lawsuits And Creditors Ebook By Alan Northcott Rakuten Kobo Higher Income Investing For Retirement Asset